In the fast-paced world of trading, every decision counts, and honing your skills can make all the difference. Enter market replay—a powerful tool that allows traders to revisit past market conditions and analyze their decisions in real-time, as they unfold.

Imagine reliving those nail-biting moments from the last trading session, dissecting your strategies, and fine-tuning your approach without the pressure of live trading. By embracing this method, you can identify patterns, understand your emotional responses, and refine your techniques.

In this article, we’ll explore how market replay can supercharge your trading skills, offering three essential tips that will pave the way for greater success in the financial arena. Get ready to transform your trading journey into a more informed and confident endeavor.

1. Practice with Real Market Data for Enhanced Decision-Making

Practicing with real market data is a game-changer for traders seeking to refine their decision-making skills in an ever-fluctuating environment. Imagine a bustling marketplace, where every tick of the price chart tells a story; immersing yourself in live market scenarios allows you to dissect those narratives.

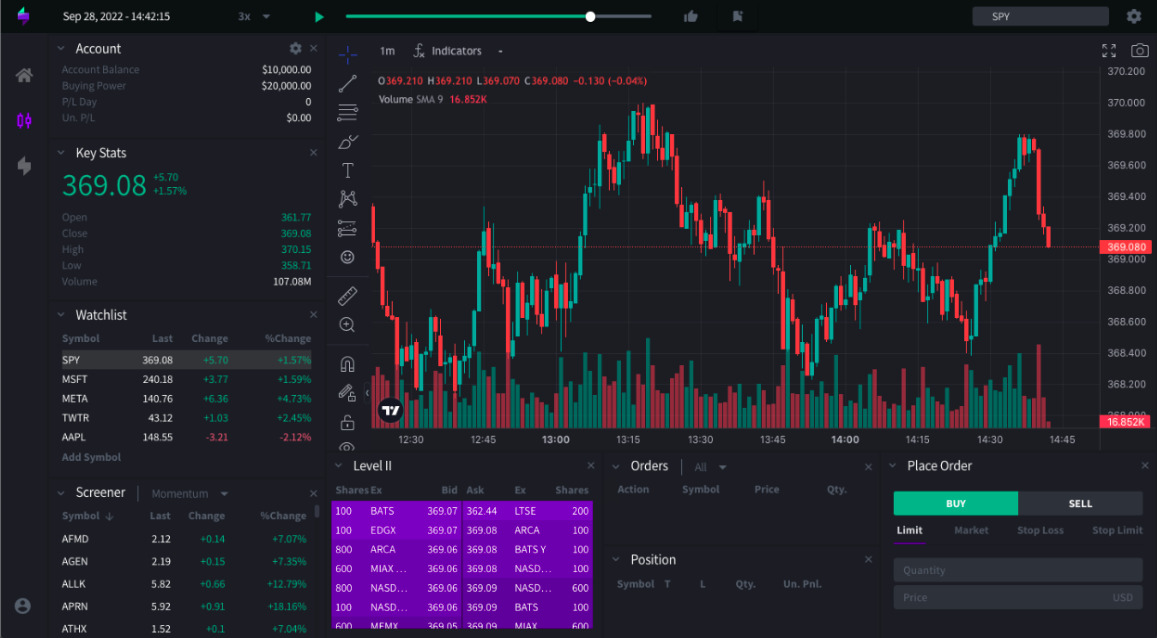

Utilizing replay chart free software, traders can engage with genuine market movements and observe volatility spikes during economic announcements, which can equip them with the ability to react swiftly and confidently when similar situations arise in the future. This hands-on experience not only fosters a nuanced understanding of market behavior but also instills a sense of adaptability—an invaluable trait in the fast-paced trading landscape.

In the end, it\’s not just about crunching numbers; it’s about cultivating an intuition that helps you thrive amid chaos.

2. Analyze Past Trades to Identify Strengths and Weaknesses

Analyzing past trades is like peering into a traders soul; it reveals not just the strategies employed but also the mindset behind each decision. By meticulously reviewing your trades, you can uncover the strengths that propelled profitable decisions—perhaps a keen sense of market timing or an instinct for spotting trends.

But beware; it’s equally vital to confront the weaknesses that lurk in your trading history. Was there a tendency to hold losing positions too long, or overreacting to market fluctuations? Each trade offers a learning opportunity, a chance to refine your skills and recalibrate your approach.

This retrospective examination allows for a richer understanding of what works and what doesn’t, ultimately laying the groundwork for more informed, confident trading in the future.

3. Simulate Different Market Conditions to Build Adaptability

To truly enhance your trading prowess, simulating different market conditions is a vital exercise that sharpens your adaptability. Picture this: one moment, youre navigating a bullish rally, riding high on euphoria as prices surge, and the next, you find yourself in the midst of a tumultuous bearish market that sends shivers down your spine.

By immersing yourself in these varied environments through market replay, you can test strategies under extreme volatility and calmness alike. This exercise not only equips you to react with poise when real scenarios arise, but it also fosters a deeper understanding of market psychology—enabling you to anticipate potential shifts in sentiment.

Whether it’s dissecting sudden spikes triggered by unexpected news or managing trades during protracted periods of stagnation, embracing these dynamic simulations bolsters your confidence and primes you for success. The more diverse the scenarios you encounter, the more versatile and resilient you become, ensuring that when the actual markets challenge you, youre not just prepared, but poised to thrive.

Conclusion

In conclusion, leveraging market replay can significantly enhance your trading skills by allowing you to analyze past market movements, refine your strategy, and build confidence in simulated conditions. By implementing the three tips discussed—starting with a clear goal, focusing on specific market patterns, and maintaining a disciplined approach to your practice sessions—you can maximize the benefits of market replay.

Additionally, utilizing free software designed for replay charts can provide an accessible and efficient means to revisit historical data and improve your overall trading performance. Embrace the power of market replay to transform your trading approach, ensuring you are better prepared for future opportunities in the ever-evolving financial landscape.